The Week Ahead Newsletter: January 27, 2025

- Conner

- Jan 27

- 3 min read

US equity futures are lower premarket, with Nasdaq leading the downside, while volatility metrics surge amid AI competition from China. Chinese start-up DeepSeek is threatening US dominance in the AI sector with a low-cost model on par with OpenAI's o1.

Monetary policy is back in focus this week as the Federal Reserve prepares to announce its first interest rate decision of the year on Wednesday. After three consecutive meetings at the end of 2024 where the central bank implemented interest rate cuts, recent economic data has shifted expectations. According to CME FedWatch Tool, there is a 95.2% probability that rates will remain unchanged.

On the earnings front, four of the Magnificent Seven companies are scheduled to report: Microsoft (MSFT), Meta Platforms (META) and Tesla (TSLA) on Wednesday, followed by Apple (AAPL) on Thursday.

On the economic calendar, participants will receive an update on GDP growth on Thursday, along with a reading on the Fed's preferred inflation metric - the core personal consumption expenditures (PCE) price index on Friday.

After a strong uptrend since the CPI release, the trend lost momentum last Friday. Our trend indicator, which uses a single moving average calculated over a 50-period window, has shifted to a neutral signal on the 15-minute timeframe.

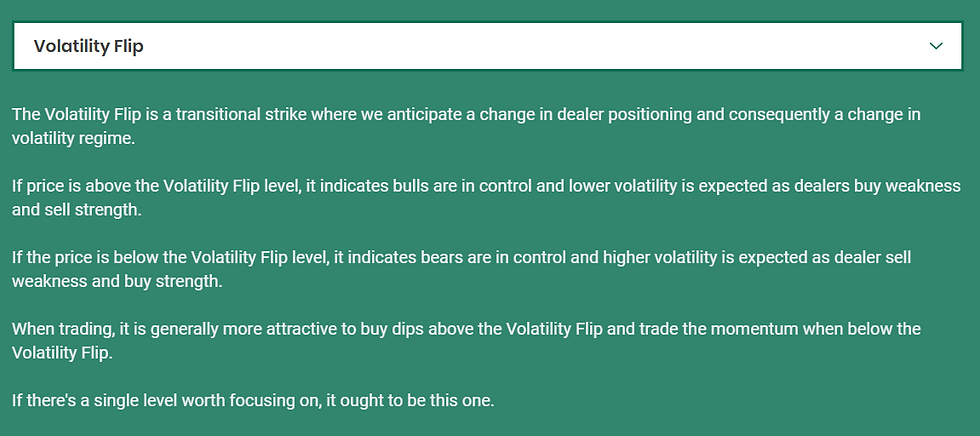

Additionally, given the overnight weakness, the SPX is well below the Volatility Flip of 6090, signaling a 'risk-off' sentiment, bears in control, and dealers short gamma, which is likely to result in higher volatility, both implied and realized, with the potential for feedback loops in both directions.

The Call Wall is at 6200, while the Put Wall sits at 5800, establishing a potential trading range for this week.

Options are currently pricing in a 2.95% move for the week (5-Day implied move), suggesting a trading range of 5921 to 6281.

On the downside, support levels are at 5920 (SPY 590 Put Wall)/5900, followed by 5870 (former H&S neckline), 5830 (FOMC low), and 5800 (SPX Put Wall).

On the upside, resistance levels are at 5950/5960, 6000 (ABS), 6020, 6050, 6090 (Flip), 6100, and 6120 (SPY 610 Call Wall).

There is no major structure in play, but there are several gaps: 6075–6049, 6007–5996, 5978–5936, and 5905–5943.

The VIX is up 40%, providing fuel for an upside squeeze if volatility sellers step in. As always, when trading below the Flip level, sustained upside is heavily dependent on a volatility down environment.

While charting the VIX is often frowned upon, key horizontal levels can still serve as useful reference points for potential pivots. Notable levels to monitor include 12-12.7, 14.7-15, 18, 19.5, 22, and 23.5.

Alternatively, since the VIX often leads the SPX, a more effective approach is to track peaks and troughs around key SPX gamma levels.

Trading FOMC

In regard to trading the FOMC, as 0DTE traders, we don't like to predict market outcomes. It is best to focus on setups and the market's reaction function. Here are some tips for trading the FOMC:

There is little to no directional edge in positioning ahead of the FOMC, making it a challenging day for trading.

Many professional traders opt to sit out entirely or significantly reduce their risk exposure.

If you aim to position beforehand, butterflies are a good low-risk strategy, or consider a butterfly strangle—a combination of two butterflies, one on the upside and one on the downside.

Apart from market-neutral strategies or directional speculation, another viable option is to trade around the press conference. Single options offer a low-risk, high-reward approach.

Keep in mind the market saying, "The first move is often the wrong move," so be cautious about chasing price, especially the initial reaction.

Market pivots often occur when Powell begins and ends his speech.

Before the FOMC meeting at 2:00 PM ET, market activity is typically subdued as participants remain in "wait-and-see" mode.

Options pricing tends to remain relatively stable, with implied volatility increasing as the meeting approaches. In other words, options may not behave in their usual manner.

Struggling to predict market direction and volatility? Join our team and gain exclusive access to our Internals Dashboard and Market Conditions Signal. Stay ahead of the curve and make informed decisions by selecting the right strategies tailored to the current market environment.

Happy Trading,

0DTE TRADERS